-

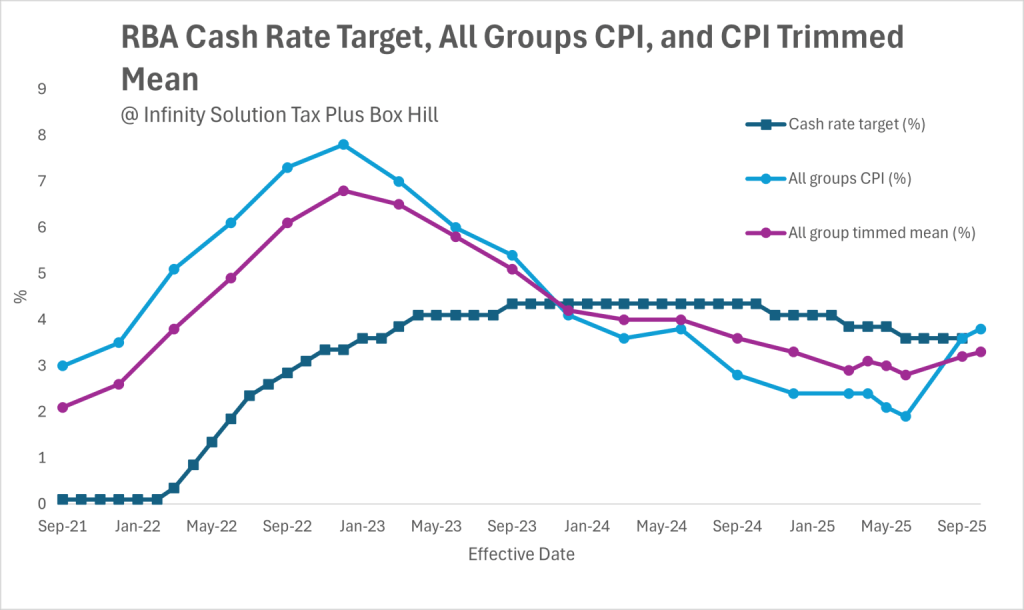

Australia’s November 2025 Consumer Price Index (CPI) data, released today, provides encouraging signs that inflation is beginning to cool, reducing pressure on the Reserve Bank of Australia (RBA) to further increase interest rates.

-

As Australia heads into 2026, the next few weeks will be crucial in shaping the Reserve Bank of Australia’s (RBA) monetary policy direction. With upcoming data releases on inflation (CPI) and employment, analysts and businesses alike are watching closely to see whether conditions may prompt a rate hike in February. For tailored financial guidance during…

-

Since our last update, both ANZ and Westpac have revised their interest rate forecasts, joining the rest of the Big Four Banks. Together, they’re now signalling a clear message — no rate cuts expected in 2026, with the possibility of a rate hike if inflation remains stubborn. This outlook underscores the importance of financial preparedness,…

-

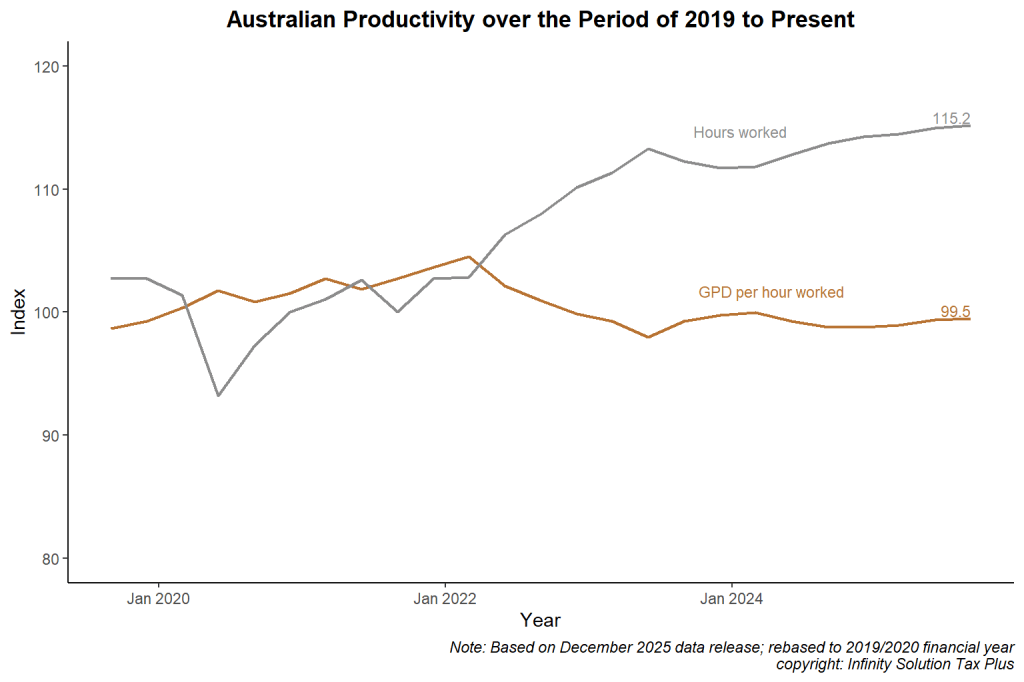

As the Australian Bureau of Statistics (ABS) releases the latest National Accounts, the December 2025 update provides valuable insight into how the economy is tracking — and what it could mean for households, business owners, and investors. Understanding these trends is essential, and working with a trusted accountant Box Hill can help you interpret how…

-

The latest data from the Australian Bureau of Statistics (ABS) shows that Australia’s labour market remains relatively tight, with the seasonally adjusted unemployment rate steady at 4.3%. This update plays a crucial role in shaping expectations for interest rates in 2026, a key consideration for households, business owners, and investors working closely with their trusted…

-

The Reserve Bank of Australia has kept the cash rate steady at 3.6% at its December meeting, a decision broadly anticipated by markets. Yet the tone of the latest statement signals a shift in direction — one that reinforces the value of partnering with an experienced accountant in Box Hill to navigate what may be…

-

The latest inflation release has again reshaped Australia’s monetary policy outlook, with October headline inflation rising to 3.8% and trimmed-mean inflation hitting 3.3%, both above the RBA’s target range of 2-3%. How will this affect the RBA’s future decisions?

-

While real estate across Australia can deliver solid returns, understanding land tax is crucial to protect your profits. Land tax isn’t a federal levy; it’s administered individually by each state and territory, meaning thresholds, rates, and exemptions vary widely. In this 2025 guide, we will break down the land tax rates and costs for every…

-

If you are a property developer or investors in Victoria, staying informed about the Vacant Residential Land Tax (VRLT) is essential. With recent changes expanding its reach across the state, engaging a trusted accountant in Box Hill can help you navigate compliance, avoiding penalties, and strategically plan your property investment.

-

The Reserve Bank of Australia (RBA) has decided to hold the official cash rate at 3.6% p.a. during its November 2025 meeting, marking the third consecutive month without a change. While this outcome disappointed many business owners and mortgage holders, the decision was largely expected, following stronger-than-anticipated inflation figures released in October. For businesses and…

- Cash Rate

- Climate Change

- Consumer Price Index

- Economy

- Finance

- General

- Investment

- Labour Force

- Policy

- Property Development

- Superannuation

- Tax

- Tax Reform

- Tax Return

Sienna Jiang is the Founder and Managing Director of Infinity Solution Tax Plus, a Chartered Accounting firm dedicated to helping clients stay financially organised while achieving their business, financial, and personal goals.

A Certified Public Accountant (CPA) with over 10 years of experience in accounting and taxation, Sienna brings broad and in-depth expertise in tax compliance, business advisory, financial reporting, and strategic tax planning for individuals and small businesses — including significant experience working with professionals in the medical field.

She works closely with clients to deliver tailored solutions in tax structuring, business strategy, and long-term planning. Her holistic approach combines practical guidance with personalised support, helping clients simplify compliance, drive growth, and reach their goals with confidence.